HCA Healthcare (HCA)·Q4 2025 Earnings Summary

HCA Healthcare Surges 11% as EPS Crushes Estimates Despite Revenue Miss

January 27, 2026 · by Fintool AI Agent

HCA Healthcare delivered its 19th consecutive quarter of volume growth, posting EPS of $8.14 that crushed analyst estimates by 9.2% despite a slight revenue miss . The market celebrated the profit beat and above-consensus earnings guidance, sending shares up 11.5% to a new 52-week high of $527 .

The quarter showcased HCA's operational resilience: revenue grew 6.7% year-over-year to $19.51 billion, net income surged 31% to $1.88 billion, and Adjusted EBITDA expanded 11% to $4.11 billion with margins improving 80 basis points .

Did HCA Healthcare Beat Earnings?

The bottom line: Yes on profits, narrowly missed on revenue.

The EPS beat was driven by disciplined expense management and margin expansion . Same-facility equivalent admissions grew 2.5%, in line with HCA's long-term 2%-3% growth target .

Full Year 2025 Highlights:

- Revenue: $75.6B (+7.1% YoY)

- Net Income: $6.78B (+17.8% YoY)

- Diluted EPS: $28.33 (+28.5% YoY)

- Operating Cash Flow: $12.6B (+20% YoY)

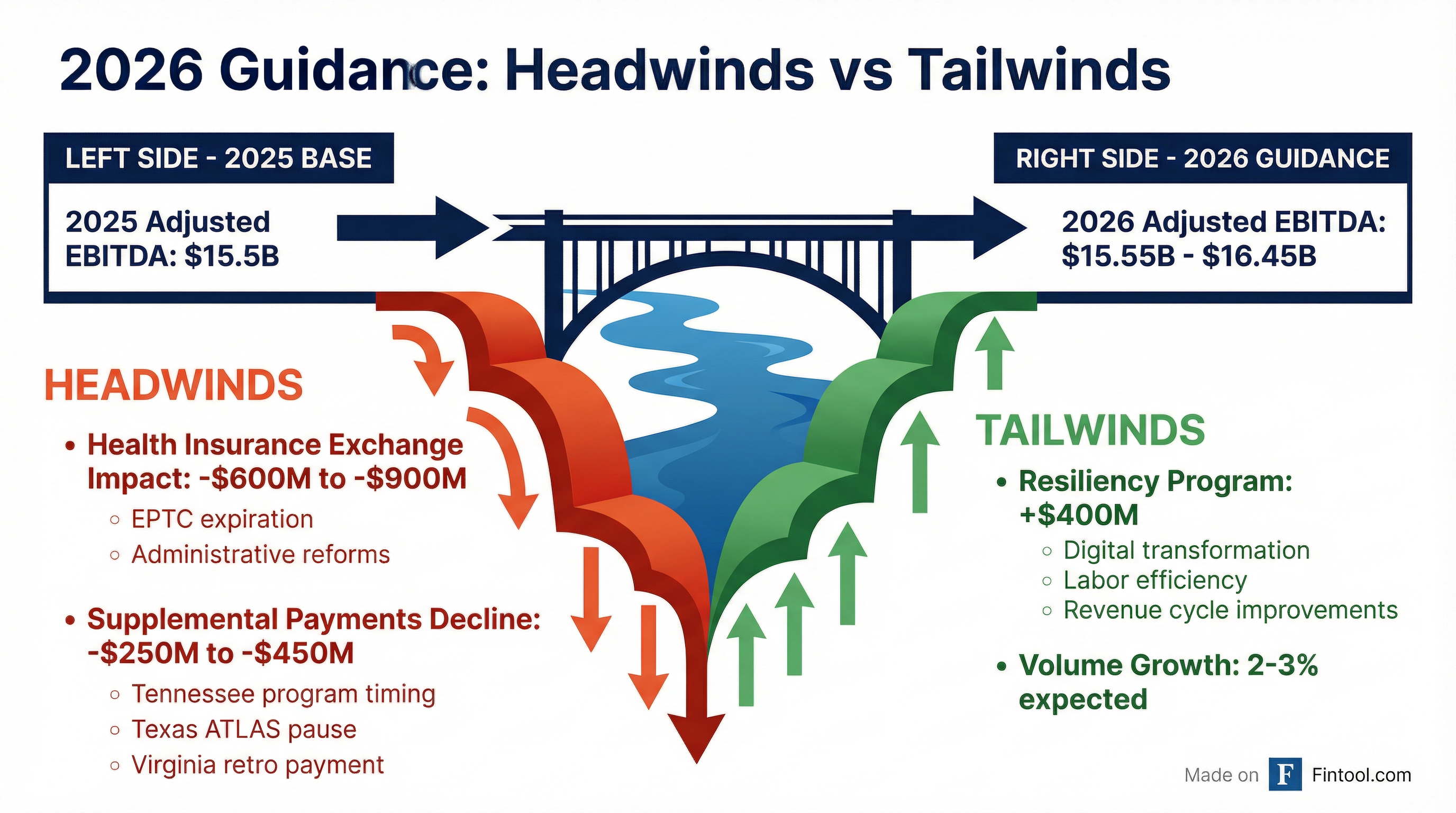

What Did Management Guide for 2026?

HCA issued guidance that beat on earnings but came in below consensus on revenue, reflecting significant policy headwinds from health insurance exchange changes.

Key Guidance Assumptions:

-

Health Insurance Exchange Headwind: $600M-$900M - Includes impact from administrative reforms enacted in 2025, the One Big Beautiful Bill Act, and expiration of enhanced premium tax credits (EPTC) .

-

Supplemental Payment Decline: $250M-$450M - Driven by Tennessee's program reverting to 4 quarters (vs. 6 in 2025), Texas ATLIS (Aligning Technology by Linking Interoperable Systems) program pause after a commissioner issued a termination notice before leaving office, and one-time Virginia retro payment in 2025 .

-

Resiliency Program Offset: +$400M - Cost savings through revenue integrity, labor efficiency, digital transformation, and capacity management .

Management's View on Exchange Impact:

CFO Mike Marks detailed the modeling assumptions: HCA expects a 15%-20% decline in health insurance exchange volumes, with approximately 15%-20% migrating to employer-sponsored insurance and the remainder becoming uninsured with an estimated 30% decline in utilization .

"We believe that the decline is somewhere in the 30% range, compared to their utilization of healthcare services when they had healthcare insurance through the exchanges." — Mike Marks, CFO

How Did the Stock React?

HCA shares surged 11.5% to $527, hitting a new 52-week high and extending the stock's remarkable run.

The market rewarded HCA for:

- Strong EPS beat outweighing revenue miss

- Above-consensus earnings guidance for 2026

- Proven operational execution with margin improvement

- Aggressive capital return — $10B new buyback authorization and dividend hike

What Changed From Last Quarter?

Volume Trends: Admissions grew 2.4% and equivalent admissions 2.5%, consistent with prior quarters and HCA's long-term target . This marks the 19th consecutive quarter of volume growth .

Payer Mix Evolution:

Exchange growth decelerated from Q3 to Q4 as Medicaid redetermination comparisons normalized .

Margins: Q4 2025 EBITDA margin of 21.1% improved 80bps year-over-year and 85bps sequentially, reflecting labor efficiency gains and expense discipline .

Supplemental Payments: A retroactive payment from Virginia pushed Q4 net benefit flat versus prior year, bringing full-year 2025 supplemental payment benefit to $420 million (vs. earlier expectation of $300 million) .

Capital Allocation: Aggressive Returns Continue

HCA announced significant capital return enhancements:

CEO Sam Hazen noted that approved capital projects now total nearly $7 billion, with investments targeting high-acuity programs, new access points, and inpatient capacity .

AI and Digital Transformation: The Long-Term Opportunity

Management devoted significant time to discussing HCA's technology agenda, which spans three domains :

1. Administrative (Revenue Cycle, HR, Supply Chain)

- AI and automation in revenue cycle

- Digital integration with payers for claims processing

- Contributing to $400M resiliency savings in 2026

2. Operational (Hospital-Level)

- Throughput and capacity management

- OR scheduling and staffing optimization

- Length of stay improvements

3. Clinical ("The Holy Grail")

- Using HCA's proprietary patient database (47 million encounters annually) to support physician decision-making

- Nursing workflow tools for shift changes and patient safety

- Pattern recognition from volume to improve care quality

"We are all in on the possibilities with artificial intelligence, merging with what I call the human intelligence that exists within our facilities." — Sam Hazen, CEO

Q&A Highlights: What Analysts Asked

On Exchange Migration Timing: Management is watching enrollment data closely and expects to know more by end of Q1 as people decide whether to sustain premiums or shift metal tiers .

On M&A Opportunities: The outpatient acquisition pipeline is stronger than in recent years, though hospital M&A opportunities haven't materialized despite balance sheet strength. HCA has 73%-74% hospital occupancy and nearly $7B in approved capital projects .

On Rural Health Transformation Fund: All 50 states have allocated program funding, but state-level details remain unclear. HCA has ~15% of hospitals in rural areas and sees this as a potential opportunity not yet reflected in guidance .

On Uncompensated Care: The company expects an increase in uninsured patients entering facilities, which immediately becomes uncompensated care. However, the impact from patients shifting from silver to bronze plans appears "relatively immaterial" based on collection rate assumptions .

On President Trump's Healthcare Plan: When asked about potential HSA-based alternatives to exchanges, CFO Marks noted it's "a little early to try to size potential impacts" as Congress determines how elements of the plan will be implemented .

On Service Line Diversification: CEO Hazen emphasized that no single division generates more than 10% of profits and no service line exceeds 15% of revenue. Cardiac services, particularly electrophysiology, continue to see strong technology-driven demand .

On Outpatient Strategy: HCA added approximately 100 new outpatient business units in 2025, bringing total outpatient facilities to ~2,700. The company targets 18-20 outpatient facilities per hospital by decade's end through both greenfield development and acquisitions .

Key Risks and Concerns

-

Health Insurance Exchange Uncertainty — The $600M-$900M headwind range reflects significant judgment around how many people lose coverage and where they migrate .

-

Supplemental Payment Volatility — Texas ATLIS pause (new executive commissioner reviewing after predecessor's termination notice) and Tennessee timing create unpredictable swings; grandfathered CMS applications not included in guidance .

-

Physician Cost Inflation — Management expects high single-digit growth in physician costs in 2026 .

-

Weather Disruption — CEO Hazen noted "Armageddon" conditions in Nashville during the call, with potential Q1 impact still being assessed .

Forward Catalysts to Watch

The Bottom Line

HCA delivered a strong Q4 with profit execution that meaningfully beat expectations, offsetting a slight revenue miss. The 2026 guidance reflects genuine policy headwinds from health insurance exchange changes, but management's Resiliency Program and digital transformation initiatives provide credible offsets. The 11.5% stock surge to 52-week highs reflects market confidence in HCA's ability to navigate the challenging policy environment while continuing to execute on volume growth and capital returns. With a new $10 billion buyback authorization and increased dividend, HCA remains committed to returning capital while investing $5+ billion annually in network expansion.

Data sources: HCA Healthcare Q4 2025 Earnings Call , company filings, and S&P Global.